Insurance policies defense is one of those things that we often overlook until eventually we really need it. It's the protection net which will capture us when life throws us a curveball. Regardless of whether it is a unexpected medical crisis, a car or truck incident, or damage to your property, insurance policy defense makes certain that you're not left stranded. But, what exactly will it mean to acquire coverage protection? And exactly how Are you aware of should you be definitely lined? Let us dive into the world of insurance plan and examine its several facets to help you understand why it's so critical.

The Single Strategy To Use For Insurance Claims Management

To start with, Enable’s mention what insurance policies security truly is. It’s fundamentally a contract involving you and an insurance company that guarantees financial assistance while in the celebration of a decline, destruction, or personal injury. In exchange for a every month or annual premium, the insurance provider agrees to cover certain pitfalls that you may perhaps facial area. This defense gives you reassurance, realizing that In case the worst takes place, you gained’t bear all the monetary stress alone.

To start with, Enable’s mention what insurance policies security truly is. It’s fundamentally a contract involving you and an insurance company that guarantees financial assistance while in the celebration of a decline, destruction, or personal injury. In exchange for a every month or annual premium, the insurance provider agrees to cover certain pitfalls that you may perhaps facial area. This defense gives you reassurance, realizing that In case the worst takes place, you gained’t bear all the monetary stress alone.Now, you could be pondering, "I’m healthful, I push thoroughly, and my property is in fantastic shape. Do I actually need coverage defense?" The truth is, we can under no circumstances forecast the long run. Incidents occur, disease strikes, and all-natural disasters take place without having warning. Insurance policy protection functions as being a safeguard against these unexpected gatherings, helping you deal with expenditures when factors go wrong. It’s an investment within your long run effectively-getting.

Just about the most common kinds of coverage defense is health insurance coverage. It addresses clinical expenses, from plan checkups to crisis surgical procedures. Without the need of well being insurance, even a brief clinic remain could go away you with crippling medical expenditures. Wellness insurance policies lets you access the treatment you would like without worrying with regards to the economic pressure. It’s a lifeline in times of vulnerability.

Then, there’s automobile insurance policy, which is an additional vital style of defense. No matter if you are driving a brand-new automobile or an older design, mishaps can happen at any time. With auto insurance policies, you might be lined in the occasion of the crash, theft, or harm to your vehicle. Plus, when you are associated with an accident where you're at fault, your policy will help protect the costs for the opposite social gathering’s motor vehicle repairs and health care charges. In a means, vehicle insurance policy is sort of a defend protecting you from the implications with the unpredictable highway.

Homeowners’ insurance policy is yet another critical variety of security, particularly when you own your very own property. This coverage shields your assets from a range of dangers, like fire, theft, or all-natural disasters like floods or earthquakes. Devoid of it, you could possibly facial area economic ruin if your private home were to get ruined or severely broken. Homeowners’ insurance policy not merely handles repairs, but additionally supplies legal responsibility safety if someone is injured with your home. It's a comprehensive basic safety Internet for your home and every thing in it.

Life insurance policy is just one area That always receives disregarded, nonetheless it’s just as crucial. Though it’s not something we want to think about, everyday living insurance ensures that your family and friends are financially secured if something were being to happen to you personally. It offers a payout towards your beneficiaries, helping them address funeral expenditures, debts, or residing charges. Everyday living insurance policy is usually a way of exhibiting your loved ones that you care, even after you're absent.

One more form of insurance policy security that’s getting to be ever more common is renters’ insurance. In case you lease your home or apartment, your landlord’s coverage may perhaps include the creating itself, nevertheless it received’t deal with your own possessions. Renters’ insurance policy is relatively inexpensive and will guard your possessions in case of theft, fire, or other unpredicted gatherings. It’s a small financial commitment that could help you save from big money loss.

When we’re on the topic of insurance policy, Enable’s not ignore incapacity coverage. It’s on the list of lesser-known different types of protection, nevertheless it’s incredibly significant. Incapacity insurance plan delivers income replacement should you turn into not able to get the job done resulting from health issues or damage. It makes sure that you don’t drop your livelihood if a thing unforeseen takes place, allowing you to definitely focus on recovery without the need of stressing regarding your finances. For many who rely on their paycheck for making ends satisfy, incapacity insurance could be a lifesaver.

Now, Enable’s take a look at the value of picking out the appropriate insurance policies company. With a lot of alternatives available, it may be overwhelming to choose the correct one in your case. When picking out an insurance provider, you want to verify they supply the protection you'll need in a selling price you'll be able to manage. It’s also imperative that you think about their name, customer service, and the benefit of submitting promises. In spite of everything, you would like an insurance provider that should have your back again after you need to have it most.

But just having coverage safety isn’t enough. In addition, you have to have to know the phrases of your policy. Looking through the wonderful print might not be pleasurable, but it’s very important to know just what’s lined and what isn’t. You should definitely fully grasp the deductibles, exclusions, and boundaries of the coverage. By doing so, it is possible to stay away from nasty surprises when you'll want to file a declare. Expertise is ability In relation to coverage.

A different facet to look at could be the probable for bundling your coverage procedures. Quite a few insurance policies organizations provide savings if you buy several forms of insurance coverage by them, including household and car coverage. Bundling could help you save funds although making sure that you've got comprehensive protection in position. So, if you’re already shopping for one particular variety of insurance coverage, it would be value Checking out your choices for bundling.

Insurance Coverage Can Be Fun For Anyone

Some Known Details About Insurance Optimization Solutions

The notion of coverage protection goes over and above individual insurance policies also. Companies need coverage too. When you have a business, you probable experience hazards that will influence your business’s fiscal wellness. Business enterprise insurance policies protects you from A variety of concerns, which include house harm, lawful liabilities, and employee-associated challenges. One example is, standard liability insurance policy can assist defend your online business if a shopper is injured on your own premises. Having enterprise insurance policies offers you the safety to work your organization devoid of continuously worrying about what may well go Improper.

As crucial as it is to own See here the right insurance policies coverage, It is really Similarly crucial that you assessment your policies often. Lifestyle alterations, and so do your insurance plan requirements. Should you’ve just lately experienced a newborn, purchased a residence, or altered jobs, your present insurance policies may well no longer be enough. By examining your coverage security per year, you make certain that you’re often adequately coated on your recent circumstances. It’s a proactive phase to protect your upcoming.

Talking of future, insurance coverage protection will also be aspect of one's extensive-time period economical strategy. Although it’s generally about masking dangers, specific varieties of insurance plan, like daily life insurance policies, might also function an financial Get it now commitment. For illustration, some existence insurance policies guidelines Use a hard cash worth ingredient that grows eventually. Which means that As well as giving defense for the family and friends, these guidelines can also work as a financial savings motor vehicle to your foreseeable future.

The underside line is insurance protection is more than just a financial basic safety Web – it’s satisfaction. It’s figuring out that, no matter what comes about, you have a cushion to fall back again on. No matter whether it’s overall health insurance, car coverage, or dwelling insurance policies, these procedures be sure that you’re not going through daily life’s worries by yourself. With the ideal insurance policies security in position, you are able to deal with dwelling your lifetime into the fullest, figuring out you’re covered in the event the surprising transpires.

Ultimately, don’t forget about the significance of being informed with regard to the evolving entire world of insurance plan. As new pitfalls emerge and laws modify, your insurance policy requirements could change. Retaining you educated on the most up-to-date trends Insurance Consultation and updates will assist you to make the top alternatives for your own or business enterprise security. In spite of everything, On the subject of insurance policy, expertise seriously is electricity. So, go to the trouble To guage your choices and make sure you’re obtaining the safety you'll need. Your long term self will thanks!

Kel Mitchell Then & Now!

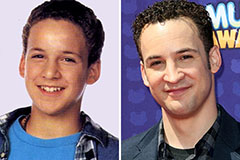

Kel Mitchell Then & Now! Ben Savage Then & Now!

Ben Savage Then & Now! Michelle Trachtenberg Then & Now!

Michelle Trachtenberg Then & Now! Barbara Eden Then & Now!

Barbara Eden Then & Now! Jaclyn Smith Then & Now!

Jaclyn Smith Then & Now!